Apr 17 2010

Newly connected solar photovoltaic (PV) capacity in Germany soared to 1.46 GW in December, almost three times the previous record rate of monthly connections of 0.50 GW set in November. This means that 38% of 2009 PV grid connections in the country were recorded in the final month of the year.

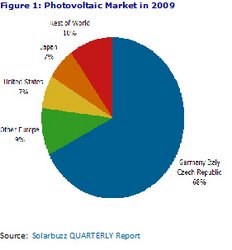

Photovoltaic Market in 2009

Photovoltaic Market in 2009

With this late surge, the 2009 PV market in Germany reached 3.87 GW and the global PV market rose to 7.30 GW, up 20% on prior year installations. This represents an increase of 0.87 GW on the previous Solarbuzz® 2009 market size determination.

According Solarbuzz®'s latest edition of the Solarbuzz® QUARTERLY Report, Germany accountted for 63% of global demand in Q4'09, taking into account the new program statistics released last week.

Q4'09 global PV market reached a record high. At 3.73 GW, it was more than seven times larger than in Q1'09, following massive growth in European demand through the year. In addition to Germany, the end-market ramp in the final quarter was also strongly driven by Italy and the Czech Republic.

The sharp Q4'09 demand increase in Germany not only sets the platform for a strong 1H'10 global demand, but also exacerbates the pressure on the German government to respond. By approaching 4 GW of newly connected capacity in 2009, the German market is running well ahead of the 2.5-3.5 GW per annum path specified in the currently proposed amendment to the Renewable Energy Act (EEG).

"The current EEG policy amendment is based on a target market range that will be overshot by a large margin in 2010, so the Government may yet choose to cut back tariffs mid-year even more aggressively than currently planned,” said Craig Stevens President of Solarbuzz, which is owned by The NPD Group. "Even without such revision, the PV industry will need to plan on a major re-balancing of global supply and demand in both mid-2010 and the start of 2011, worse than the one that occurred from the policy adjustment in Spain in 2008.”

For the time being, early 2010 market strength is creating a period of relative pricing stability, compared to the 2009 turmoil. Having fallen 22% between Q1'09 and Q4'09 after the decline of the Spanish market at the end of 2008, crystalline silicon module factory-gate prices are projected to show a slight upturn in Europe through most of Q2'10.

"Once German policy adjustments have been implemented, 2H'10 and early 2011 corporate outcomes will become dependent on the discipline of downstream companies to manage inventories and on the manufacturers to adjust production levels in line with shifts in the quarterly demand pattern,” Stevens added.