Jul 15 2009

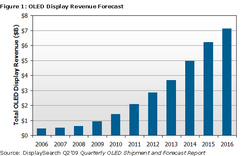

In its latest Quarterly OLED Shipment and Forecast Report, DisplaySearch forecasts the total OLED display market will grow to $7.1 billion by 2016, from $0.6 billion in 2008, with a CAGR of 36%.

DisplaySearch also reported that in Q1'09 worldwide active matrix (AM) OLED revenue surpassed passive matrix (PM) OLED for the first time. AMOLED revenue is increasing strongly due to strong mobile phone main display shipments, as Nokia, Samsung Electronics, and Sony Ericsson heavily promoted AMOLED mobile phones in first half of 2009. More than 10 mobile phone models with AMOLED main displays have been released in 2009.

PMOLED has been the revenue leader in the OLED display market, driven by high unit shipments. However, in Q1'09, PMOLED shipments were down significantly due to weakness in MP3 and mobile phone sub-display applications.

"AMOLED displays have become an important differentiating feature for high end electronic products," noted Jennifer Colegrove, PhD, Director of Display Technologies at DisplaySearch. "As we forecasted, AMOLED revenue surpassed PMOLED revenue in Q1'09, and AMOLED is likely to pass PMOLEDs in terms of unit shipments in 2010. There will be about 20 new or upgraded AMOLED production lines installed or upgraded worldwide in the next three years," Colegrove added.

The company also reported that worldwide OLED display revenue in Q1'09 was $143 million, down 8% Q/Q. AMOLED revenues were up 17% Q/Q.

Samsung Mobile Display (SMD), created from Samsung SDI's OLED business and Samsung Electronics' mobile display business, started operation in January 2009. SMD had a strong Q1'09, and as a result, it kept the #1 position in shipment with 37% market share, followed by RiTdisplay at #2.

OLED manufacturers are planning to make TV panels larger than 11" in 2009; LG Display is mass-producing small-size AMOLED currently, and has announced it will mass-produce 15" AMOLED panel for TV application at the end of 2009. LG Electronics announced that it will commercialize 15" OLED TV for the holiday season.

DisplaySearch's Quarterly OLED Shipment and Forecast Report includes shipments by each supplier; AMOLED vs. PMOLED; small molecule vs. polymer; monochrome vs. area color vs. full color; and shipments by application, such as mobile phone main display, sub-display, mini-note, notebook PC, TV, MP3, auto console, car audio, digital still camera and near-eye. It also shows capacity plans by supplier and has a comprehensive supply/demand forecast. This report is delivered in PowerPoint and includes Excel pivot tables. If you need further information or assistance please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan.