Feb 24 2015

Technology market research firm Infonetics Research, now part of IHS Inc., today reported that global spending on wavelength division multiplexing (WDM) equipment, which is used to build more efficient optical networks, grew 6 percent in 2014 from 2013, to $10 billion.

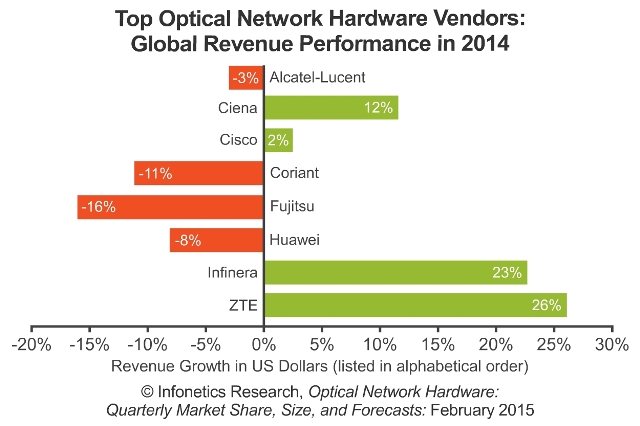

There were radically different results by vendor and by region in the the optical network hardware market in 2014

There were radically different results by vendor and by region in the the optical network hardware market in 2014

Infonetics' early edition Optical Network Hardware report contains vendor market share and preliminary analysis for the global optical equipment market for the fourth quarter of 2014 (4Q14) and the full-year 2014.

"The North American optical market diverged sharply in 2014, with strong results from Adva, Infinera and Ciena balanced by major weakness at traditional vendors like Alcatel-Lucent, Fujitsu and Coriant," Andrew Schmitt, principal analyst for carrier transport networking at Infonetics Research, said. "The pattern here could not be clearer: companies whose fortunes are tied to traditional carriers are underperforming. Yet the press and investor echo chamber's fascination with AT&T and Verizon spending inexplicably remains."

"One important note on the EMEA region: when measured in euros, fourth quarter WDM optical spending surged 14 percent from the year prior. This has no precedent in the past five years," Schmitt said.

OPTICAL MARKET HIGHLIGHTS

- While global WDM optical hardware revenue is up, SONET/SDH gear continues its downward spiral, down 25 percent in 2014

- Combined, the WDM and SONET/SDH optical network equipment market totaled $3.2 billion in 4Q14, up 7 percent sequentially, and up 3 percent from the year-ago quarter

- For the full year, the overall optical network hardware market ended down 1 percent in 2014 over 2013

- The end-of-year capex surge is still in fashion in EMEA (Europe, Middle East, Africa), where optical spending surged nearly 50 percent from the previous quarter

- Ciena became the second largest optical vendor in the world in 2014, just edging out Alcatel-Lucent; Huawei remains number-one

- Infinera, the fastest-growing optical company in the West (North America and EMEA combined), was the big success story for 2014, with 23 percent revenue growth from the previous year, followed by Ciena at 12 percent

- Cisco optical revenue was up 2.4% for the year as the company seeks customers for its NCS 4000 platform and re-orients sales efforts due to the rapidly changing tastes of traditional customers in the enterprise and data center markets